Risks of Dollarization of South Sudan Economy

Dollarization Definition:

According to the International Monetary Fund (IMF), “dollarization is a financial phenomenon where a country adopts the US dollar as its official or parallel currency. This practice can enhance economic stability but restricts the nation’s independent monetary policy, impacting various sectors and investment decisions.

As a sovereign country, South Sudan has not officially declared full or partial dollarization of the country’s economy. But practically, local businesses prefer dealings in dollars rather than the South Sudan Pound; this is dangerous to our economy.

In our situation today, South Sudan Pound is coexisting with the U.S. dollar, in some sectors, such as the Housing Markets, the Pound has been completely replaced by the dollar. This phenomenon has occurred due to reasons, such as economic instability, hyperinflation, or a lack of confidence in the local currency.

It is an economic setback for a developing country such as South Sudan. For example, housing rents in Juba range from $ 300, 400, 500, 600, and 700, to 1,000 dollars. Let us estimate that there are 1,000 houses at the cost of USD 3OO per month; that is $300,000. 1,000 houses for $ 400 is $400,000, 1000 for $500 is $500,000, and 1000 houses for $700 is $700,000, and 1000 for $1,000,000.

This is housing sector alone. All these dealings is outside the official channels. This hard currency gained by the house owners or landlords do not find their way to the banking sectors or the central bank to be kept as reserves for imports and exports of goods and services. They are responsible for prices hike in the food market.

These calculations show that the housing market is a big player in the economy and can influence the monetary policy of our country. The National Ministry of Finance and Economic Planning plus the Central Bank and the government as a whole should set policies and regulations to control the housing market. In my humble opinion, the government of South Sudan should pass policies and regulations to ban house rents and office blocks in US dollars.

The dollarization of our economy has caused us to surrender control over our monetary policy. We have lost our monetary autonomy because our monetary policy is being controlled by foreign countries. The dollarization of our economy has spelled a disaster for our developing nation which relies on a currency that is not ours. It is now difficult for South Sudan to fully develop as we do not have control over the money supply and currency within our nation. We are extremely in a difficult situation because restrictions on foreign currency could also turn into an exodus of multinational companies who only set up shop in our country. After all, they could use foreign currency.

The Ministry of Finance and Economic Planning should consider the housing sector seriously in its fiscal, financial, and monetary policies in the overall economic master plan for the country. The housing sector is vital in macro-economic policies and planning.

Houses and offices should be rented in South Sudan Pond. I called upon the leadership of the Central Equatorial State government, the top brass of the National Ministry of Finance and Economic Planning, and in addition to the leadership of the security sectors and other organized forces to enforce the policy of rent payments in South Sudan Pounds. For example, in Egypt, a tenant rents a house from a landlord paying in Egyptian pounds, In Uganda a house is rented in Ugandan Shillings, and similarly in Kenya; is a house rent is paid in Kenyan Shillings.

In these countries, you don’t see dollars being traded in the streets. They are traded in banks or foreign exchange bureaus. These are officially registered and recognized venues for foreign currency trading.

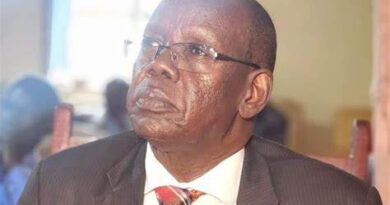

By Mr. Mathiang Jalap Dongrin, Senior SPLM Activist and Political think tank. & Monetary policy in south Sudan.